A few months back, I carried out a survey on personal finances. The goal was to study the impact of the pandemic on personal finances and delve a little deeper into the behavioural aspects of personal financial management. One of the areas studied was budgeting; the systematic approach of planning (and predicting) one’s cash flows so that it can sustainably meet recurring expenditure and long-term needs. 56.2% of the respondents indicated that they budget on a monthly basis, 37.5% used budgets for cash heavy projects only, and the remaining 6.3% did not budget at all citing irregular earnings and a lack of income as the key reasons for not budgeting. There was a general consensus, however, that COVID19 had made budgeting necessary and it was important to do so consistently.

Last week’s article extensively covered the SMART budgeting process. Today’s post takes an illustrative route with the hope of stirring a little more learning, a little more thinking, and a little more budgeting.

STEP 1

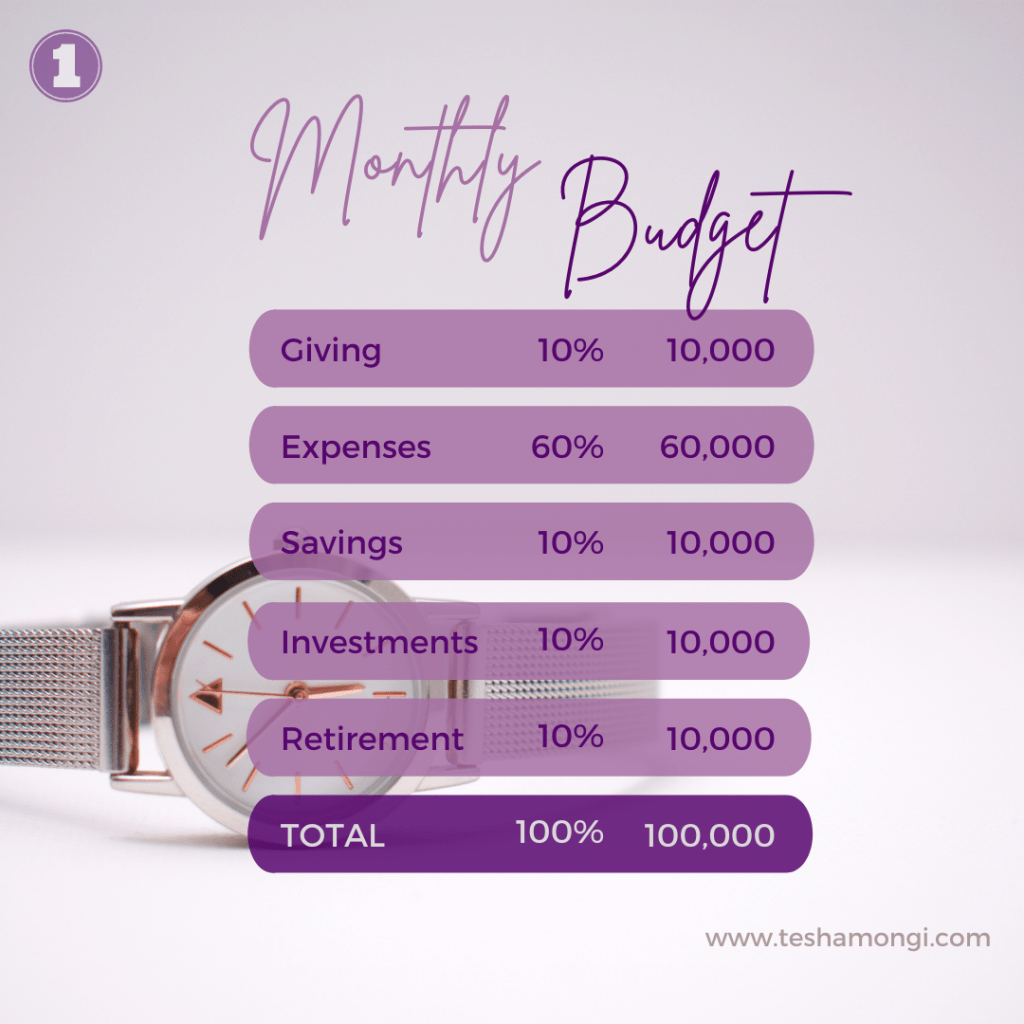

Setting up your monthly budget

The SMART budget is a prestructured budget that prescribes a 10%, 60%, and 30% cash allocation to giving, spending and investing respectively. Ideally, the prestructure is to help anyone who wants to kick-start their financial planning process, feels stuck or is dissatisfied with his or her budgeting process, or simply wants to get a different perspective on how to budget. Given that the cash flow categories are preset, the task here is to figure out one’s income. For the employed, this is simple as salaries are not erratic and usually fixed for a period of time. The self employed or those whose receive an irregular income need to work backwards by taking a look at their bank statements or mobile money transactions so as to determine their estimated cost of living and average monthly income.

STEP 2

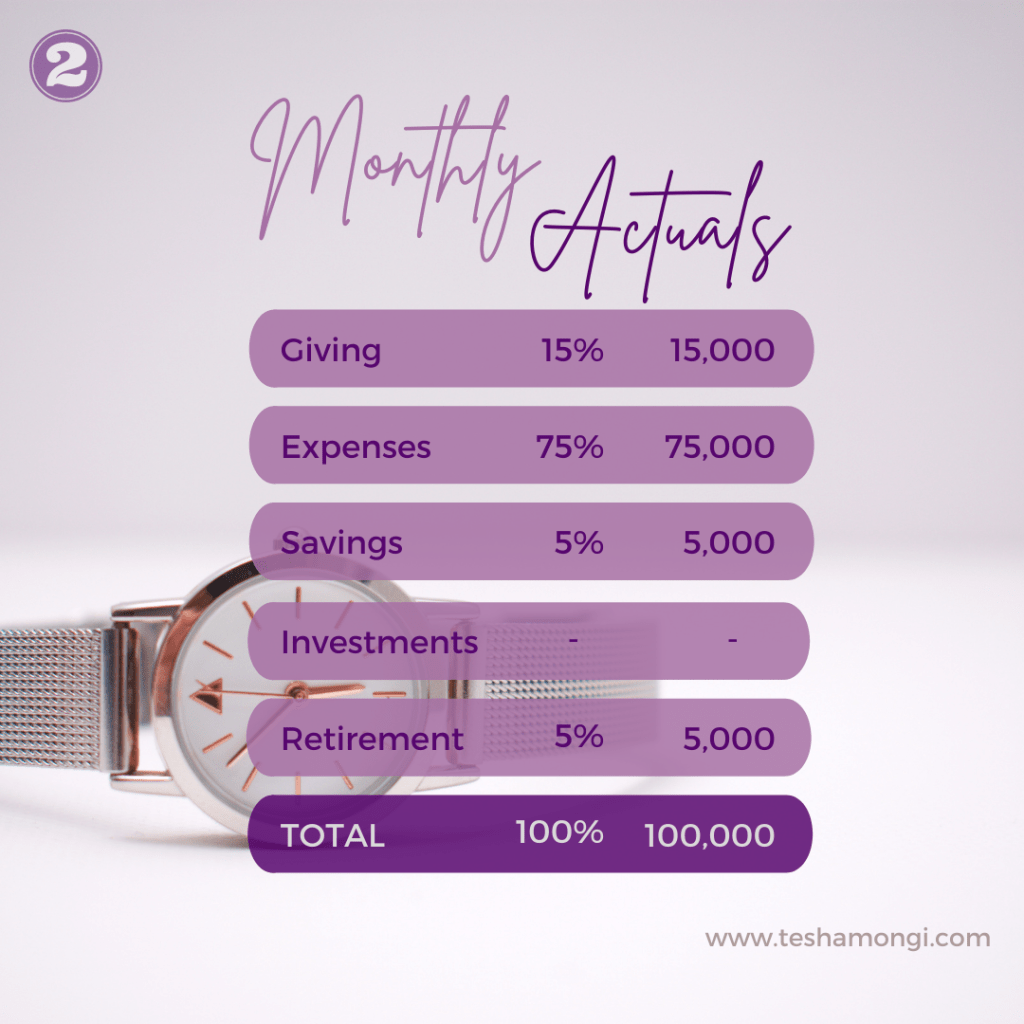

Tracking the actuals

Once the budget is up (on paper, Excel or APP), you need to track your spending and ensure that everything is going as planned. The tracking process can be a very onerous endeavour but it gets easier and there is also easier ways of doing ‘hard’ stuff.

- Settle all your bills and commitments on a specific date. Say the first day of every month. This will prevent you from making payments haphazardly and ultimately financial decisions. You’ll begin to be clear about your primary obligations and even know them by heart. It will also give you time to think through your investment decisions and see what your budget can and cannot accommodate.

- It may be easier to automate bill payments or place standing orders for specific expenses particularly if you have an extremely busy schedule. You may, however, need to confirm what your bank charges as such service fees may turn out to be high.

- Set calendar reminders to help you manage ad hoc transactions and especially those that attract penalties or would make you suffer some disadvantage such as motor insurance, professional subscriptions and income taxes. Circle your wall calendar with school term dates so that fees payments do not turn into emergencies. Better still, keep a one year budget reflecting all the obligations you need to cater for through the year.

- Get into the habit of checking your statements, your mobile money transactions, and even receipts. It will not only make you financially aware but you will want to spend your money better.

- Do not walk around with more than necessary cash. Wire those extra funds lying in your current account into a fixed deposit or money market account where frequent access is restricted. Close bank accounts that you no longer use.

Step 3

Getting into the details

Just once in our lifetime (3 straight months actually), we must challenge ourselves to keeping a daily log of our financial transactions. This is a useful process that reveals our true spending amounts, our priorities and impulses too. We begin to realise that small transactions that we normally ignore add up to decent sums when aggregated. We discover that we either overestimated our expenditure and could actually manage better with what we have. Getting into the details allows us to establish our true income levels. There are some cash receipts we may miss out when thinking salary only. What about SACCO dividends and sales commissions and bonuses or a loan to a friend repaid? When our real earnings are put against expenditure, we see the need to work harder or smarter. There is a case for seeking other sources of income. Investing begins to make sense.

Step 4

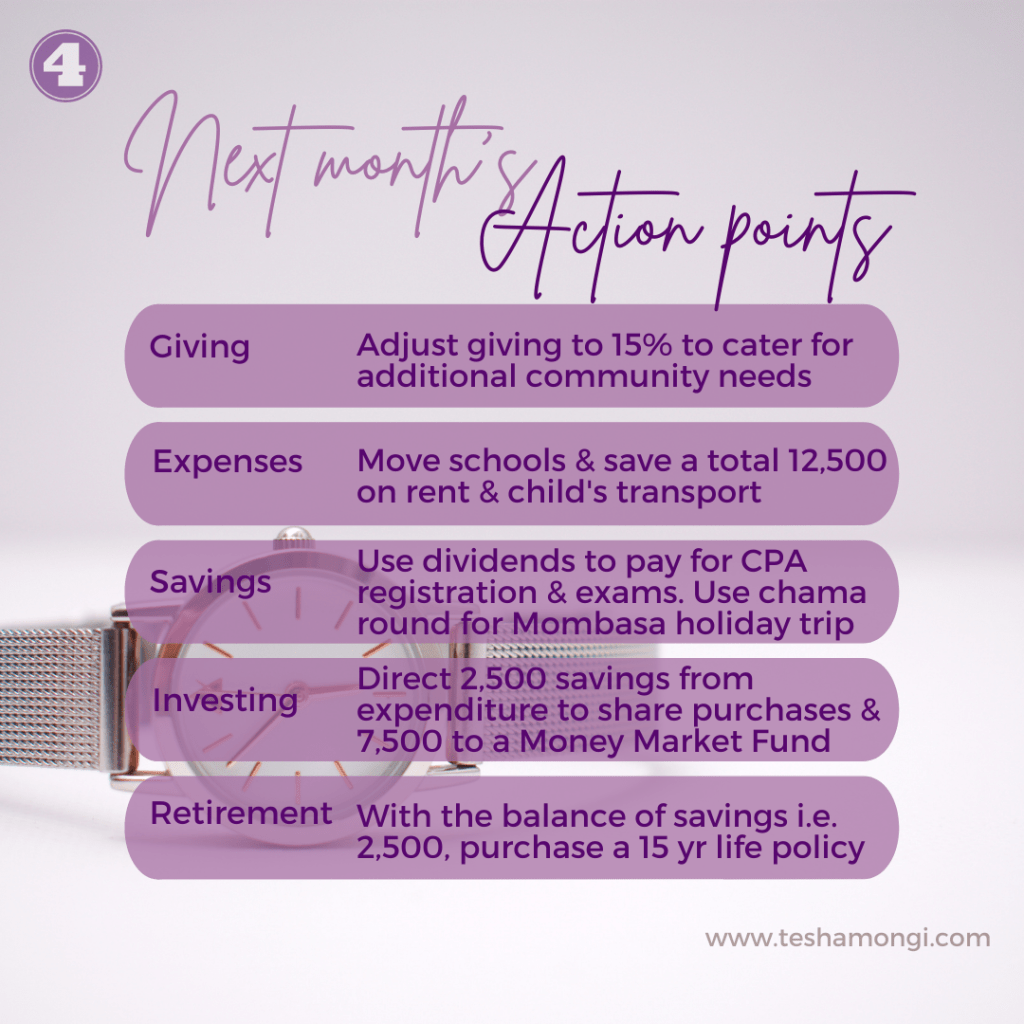

Making budget adjustments

Making adjustments to a life we are accustomed to is an uphill task. It is like trying to break an addiction and each time the brain feels a reward it is used to is being denied, it gets triggered to increase ‘cravings’ for the very same experience. Clarity regarding our financial status allows us to make informed choices with our money. We begin to work with the brain to build a new reward system. The rewards could look like healthy living as a result of eating in, peace of mind after moving to a more affordable apartment, fully covered medical bills from having a good medical cover.

Step 5

Revising your budget

Once you’ve reviewed your budget and figured out what you’d like to change, you need to type it out for reference. For faster wins and greater motivation, focus on a single area at any one given time. If you are deep in debt, sort that out first. It may take you a couple of months or even years but if you keep at it, you will get out of debt. To avoid random or presumptuous decisions, you may want to restrict budget revisions to every 3 months. This way you give yourself time to build the muscle towards a disciplined financial life.

At the very onset of budgeting, you’ll run into many bumps but keep at it. Keep at it even if the estimates seem to be way off. Keep at it even if inflation seems to be biting off huge chunks of your budget. Keep at it… For if you lay the foundation and are not able to finish it, everyone who sees it will ridicule you, saying, “This person began to build and wasn’t able to finish.” Luke 14:29-30 Have a wonderful weekend 🌻 🌻 🌻