PART I

A couple of years ago, I came across an idea that changed the way I budget. It proposed that the first 10% of our income be allocated to giving, the next 60% to expenditure, and the final 30% to savings & investments. There was no specific guidance on how much should be directed to a particular savings and investments category but I thought that an equal split of 10% each would make the budget, a SMART budget.

SMART is an acronym that stands for Specific, Measurable, Achievable, Relevant, and Time-bound. It is a criteria used to guide setting of goals, focus efforts and increase chances of goal achievement. A couple of reasons why I continue to subscribe to this method of budgeting are:

- It is simple in every aspect and provides some good level of specificity regarding what we should be doing with our money. I am sure you will agree that the pictorial above encapsulates everything a person would want to achieve financially. Live, love, laugh and leave a legacy behind. The very compass needed in meeting immediate, short-term and long-term personal finacial goals.

- It is the pure definition of measurable. Percentages are one of the best expressions in determining progress, performance and even perfection. Perfection in this context would be the achievement of permanence in a certain area of budgeting e.g. bringing down expenses from say 115% of one’s income to a constant average of 80%.

- This concept makes Big Hairy Audacious Financial Goals look achievable. Consider this. Your monthly household income is KES 150,000 and you have heard that it is worthwhile investing at least KES 100,000 in the stock market so as to receive decent dividends. What do you think would be immediately possible? Making a one-time payment of KES 100,000 to the Exchange or committing 5-10% of your income towards monthly share purchases.

- There is not a single category in the proposal that feels unnecessary. They are all relevant and in tandem with many of our dreams. Obviously a further breakdown of each category would make the budgeting and expenditure tracking process more useful but this big-picture vision is the fuel needed for consistent action.

- The fact that this budget is pre-structured means it can be implemented immediately and be time-bound for results. Reviews can then be carried out against progress on a monthly, quarterly, annual or even crisis basis.

PART II

Let’s take a closer look at these 5 categories of the SMART budget.

- Giving is a huge part of the human nature, societal culture and personal faith. It is a beautiful thing, a necessary act and a way of life. I’d say that 10% is a reasonable floor but if unchecked could place us in distress, disadvantage or disillusionment about acts of love and mercy. I plan to explore this subject in a later article but think it’s pretty okay to put a cap on your giving. Actually The Good Book says “Each of you should give what you have decided in your heart to give, not reluctantly or under compulsion, for God loves a cheerful giver.“ 2 Corinthians 9:7

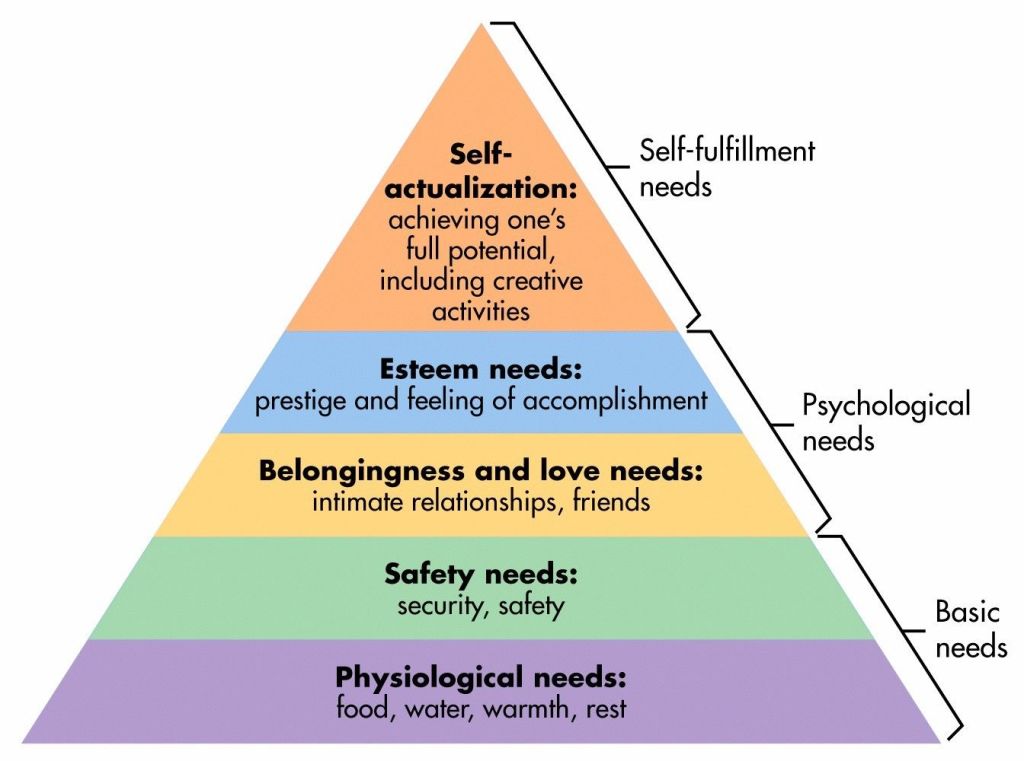

- Expenses. The crux of any budget is in expenditure control. There are a couple of things that make managing expenses difficult. Absolute lack of resources usually resulting from unemployment or lack of business opportunities. Limited resources coupled with increasingly legitimate personal and family needs. Unending debt on one hand and limited access to credit on the other. Impulse buying and wasteful behaviour in general. The inability to prioritise, however, is what makes or breaks a good budget. Needs and wants must clearly be separated with food, water, clothing, shelter, education, sanitation and healthcare (basic needs) taking the first positions on the list. Remember Maslow’s Hierarchy of Needs? I cannot recall when they first teach this theory to students but there is a reason they keep on teaching it. From a personal finance perspective, it (pictured below) can help us think through our needs and perhaps reveal interesting motives behind our sometimes irrational purchases. Once priority needs have been figured out, everything else can come in. Furniture and fittings, electronics and elegantries, vehicles and vacations. Well, just right after sorting out our short-term and long-term investing plans. For the gratification of wealth is not found in mere possession or in lavish expenditure, but in its wise application (Miguel de Cervantes, 1616).

- Savings. Savings and investments go hand in hand. The logic behind the 3-part split, however, is to make sure that good attention is paid to each subcategory e.g. saving for short-term needs through emergency and sinking funds, saving for long-term real estate projects, saving for life after retirement. If you are heavily in debt, it only makes sense to focus your energies to bring down the amount to a manageable level. Once your debt situation is sorted, you will be able to peaceful pursue other financial activities.

- Investments. The idea behind investing is to purchase an asset that will provide a consistent return or sell for a higher price in future. The 10% recommendation in the model is two-fold. Discourage us from aiming too low that we hit almost nothing. Encourage prudent investment decisions that also cushion us against a total erosion of our capital. That said, we all have different capacities. Some will struggle to meet the 10% target, others will be able to do much more. Whatever the case, it always good to remember that KES 1,000 consistently invested in a 8% interest bearing instrument for a 120-month period will yield a total sum of KES 182,946.

- Retirement. Too young to retire? It is very easy to put our retirement plans on the back burner. This budgeting notion pushes us to think about our less active years which the Government of Kenya pegs at 60 years. Early retirement at age 50 is also permitted. Some quick math on how long you have until retirement will perhaps get you thinking 😀

PART III

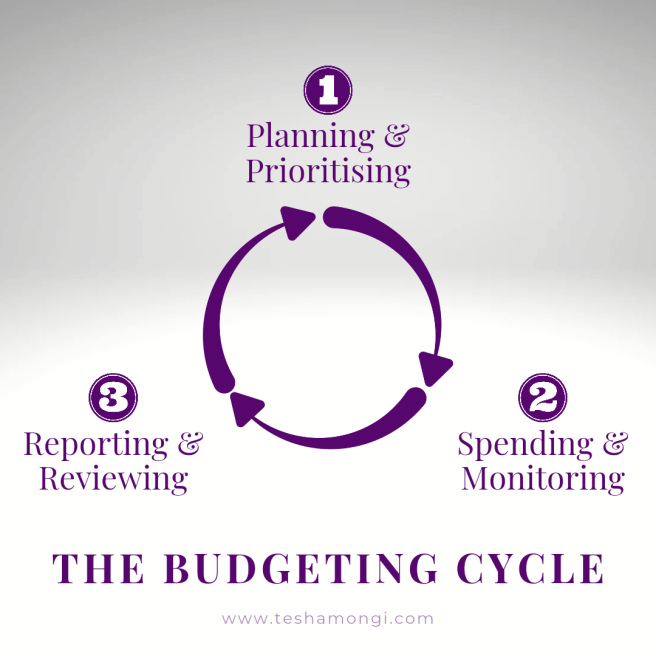

To wrap up this article, it is important that we understand the 3 phases to successful budgeting.

Phase I: Planning & Prioritising

Parts I and II of this article are essentially on planning and prioritising. There are a million tools and resources available online but the secret is in selecting a system or template that works for you. Committing the process to pen and paper (or on an Excel sheet or through an APP) is where the real work is. It is a worthwhile endeavour and I can assure you’ll be surprised by how much can be achieved by simply spelling out your desires. A budget is a guesstimate and therefore doesn’t have to be perfect. It just needs to be good enough to guide you through the month, quarter or year. As you keep at it, you’ll begin to see the results that the peeps at finance keep singing about.

Phase II: Spending & Monitoring

A budget, also known as a spending plan, is a mathematical tool that assists you in allocating your resources appropriately. I can’t think of a better way to emphasise of this step than through a illustrative article planned for next Friday. Scout’s honour 🙂

Phase III: Reporting & Reviewing

Finally, it is imperative that you check how you are getting along with your goals. Are you now paying your bills on time? Have you witnessed a reduction in your total personal debt? Has your first dividend payment from the stock market come through? Is the budget helping you get more organised? Are you starting to feeling hopeful about your financial situation and beginning to experience a transition from a chaotic lifestyle to a more choreographed one? Your budget needs to be more than a spending tracker. Reporting and reviewing will make the process more functional. Furthermore, a spotlight on your financial position will allow you to pursue opportunities that you would have otherwise thought impossible. Budgets also provide a rational framework for handling financial challenges and crises because money decisions can be very emotive.

A little homework…

- Do you keep a monthly budget? What do the percentages look like in comparison to the above criteria?

- Have you ever tried creating a crisis budget? One that can help you weather financial storms? If not, try setting up one and think substitution i.e. items that can be swapped for cheaper ones. Think elimination and begin to imagine letting go of that extra car. Think resuscitation and make sure that important items such as health insurance, continuing education and endowment funds are covered.

- A final question – which perhaps should be answered in the comment section – what makes budgeting difficult for you? PS: The comment section has been designed to allow for anonymous responses and discussions.

Like. Comment. Share. And do have a wonderful weekend 🌻 🌻 🌻